Recent Posts

- Is Home Staging Worth It? March 25 2025

- What Is the Difference Between Estate Tax and Inheritance Tax? March 24 2025

- How to Sell Your House Fast in Austin, TX March 11 2025

Selling your home? One of the biggest hurdles between you and closing the deal is the home appraisal. This crucial step determines your home’s fair market value and directly impacts whether your buyer’s financing gets approved.

A low appraisal can lead to unexpected challenges, such as renegotiating the price, making last-minute repairs, or even delaying the sale. But with the right preparation, you can avoid surprises and ensure the market value of your property is as high as possible.

So, how can you set yourself up for success? Follow this step-by-step home appraisal checklist to understand the appraiser’s role, what they look for, and how to prepare your home for the best possible outcome.

Appraisers work independently as licensed professionals who give a trustworthy opinion of value to federally regulated lenders. They have qualified knowledge of the area’s real estate market conditions so they can accurately come to a home’s true value. This ensures the lender and buyer aren’t overpaying and that the seller is receiving an unbiased and accurate price for their house.

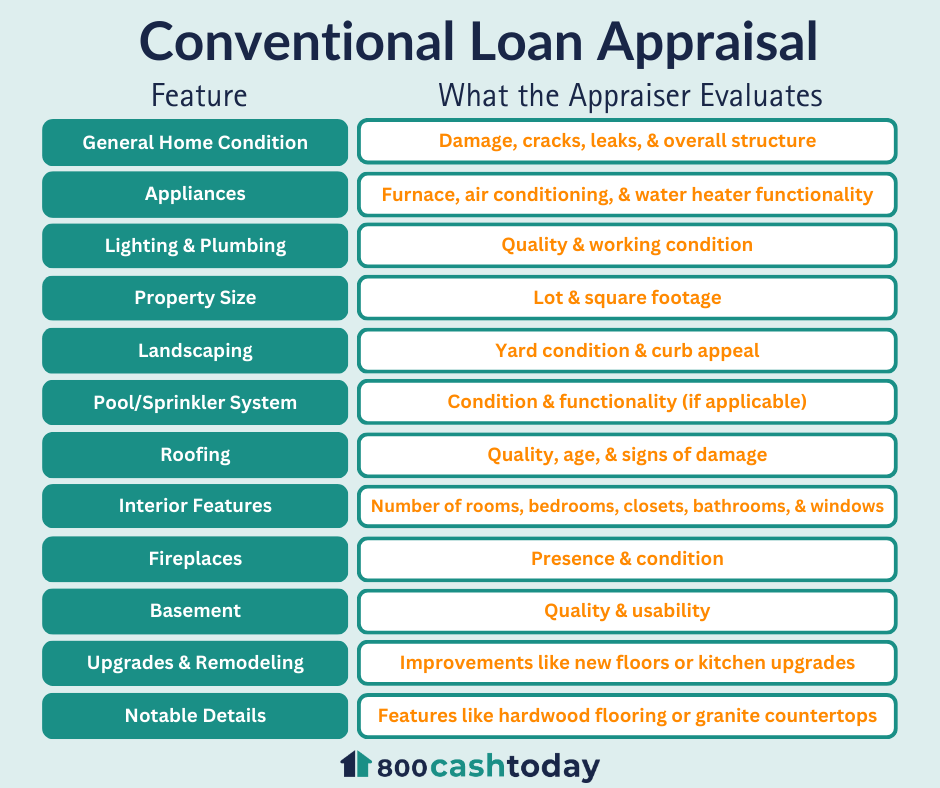

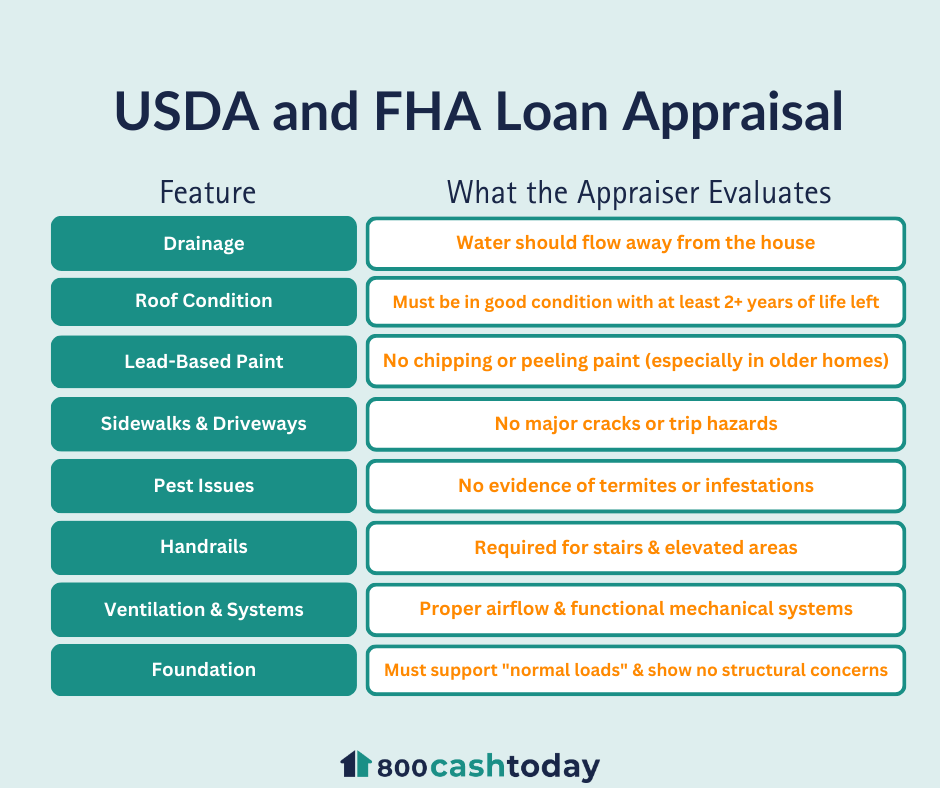

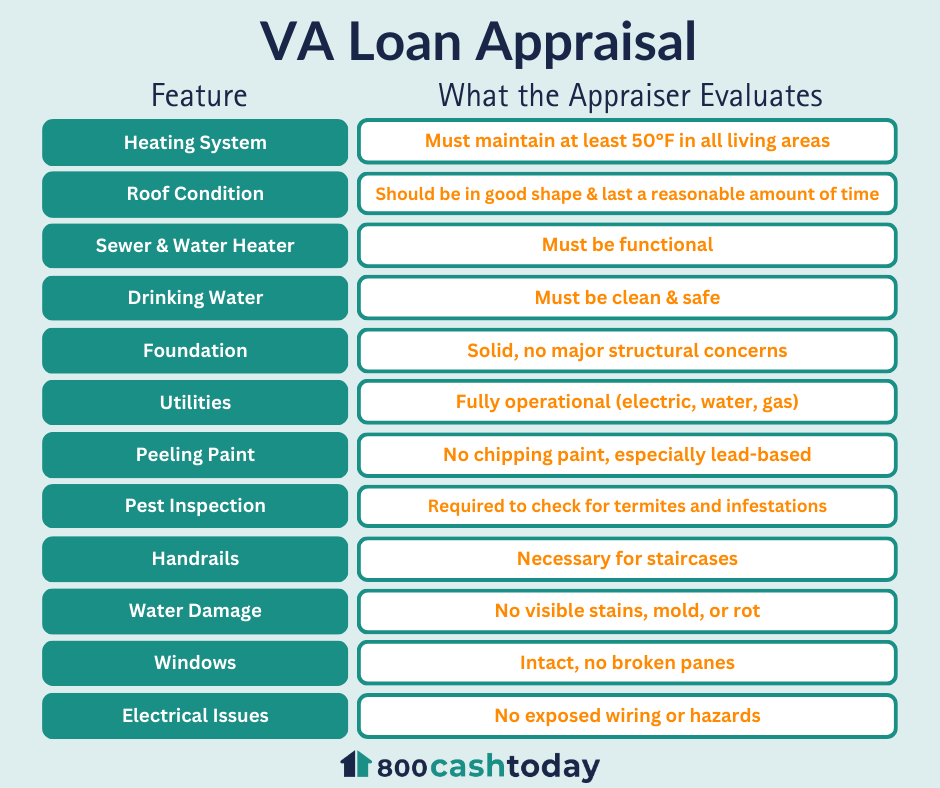

Appraisers assess both your home’s market value and condition, but the criteria vary based on the buyer’s loan type—conventional, FHA, USDA, or VA. Government-backed loans have stricter safety and structural appraisal requirements, which can impact your sale if issues arise.

Use the tables below to review what appraisers check for your buyer’s loan type and take action ahead of time to fix potential red flags. Addressing small issues now can help prevent delays, renegotiations, or a lower-than-expected valuation.

A conventional loan appraisal focuses on assessing a home’s market value and overall condition to ensure it meets lender requirements. While not as strict as government-backed loans, appraisers will check for any significant issues that could affect the home's value.

United States Department of Agriculture (USDA) and Federal Housing Administration (FHA) loans follow guidelines set by the U.S. Department of Housing and Urban Development (HUD). These loans focus on both the home’s value and safety, meaning appraisers must check for potential hazards or issues that may impact the buyer's ability to secure the loan.

VA loans are government-backed, and appraisers must be VA-licensed. They issue a Notice of Value (NOV) that includes the final home value and any required repairs before closing. These appraisals focus on the home's safety, durability, and livability for veterans and their families.

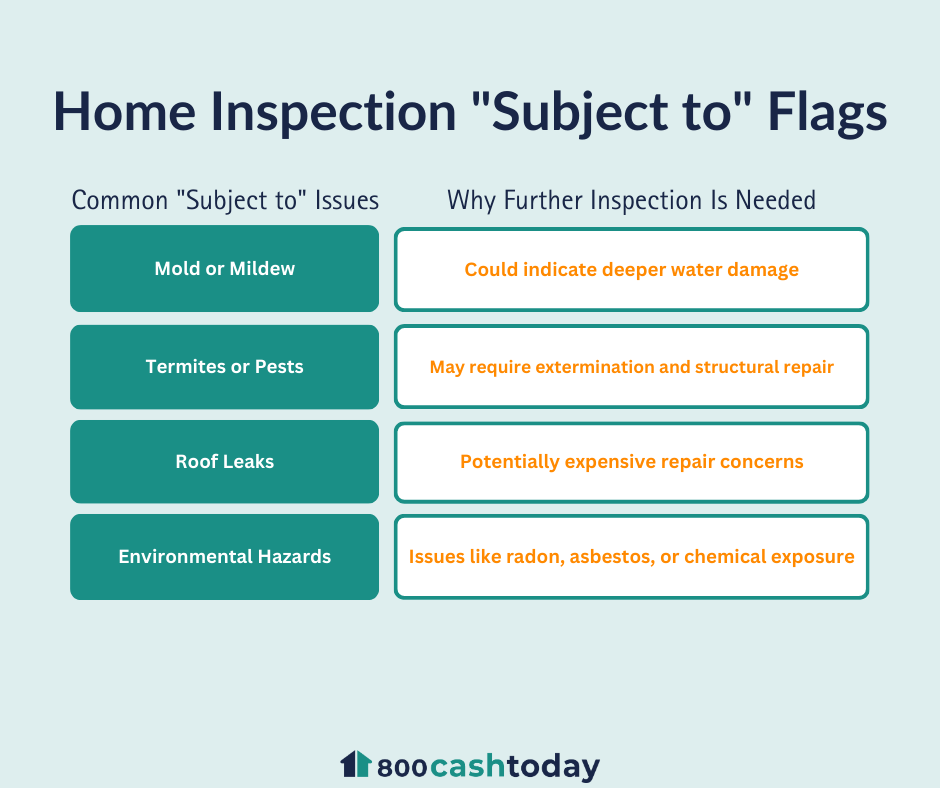

During an appraisal, certain issues may be marked as "subject to" further inspection, meaning they need professional assessment before loan approval. This happens when an appraiser identifies a potential concern but lacks the expertise to confirm its severity.

If flagged, these issues must be resolved before closing, or the buyer may not secure financing.

Typically, the buyer pays for the appraisal once the seller accepts the buyer’s offer. The appraisal process can range anywhere from $314 to $423, depending on location and property type.1

The on-site portion of the appraisal can take as little as 20 minutes to a couple hours as the appraiser goes through the home taking photos of the property to document its condition.

After that, it can take three to five days for the appraiser to write an appraisal report and send it to the buyer’s mortgage lender.

Appraisers often work on tight deadlines, especially in competitive markets, and delays in scheduling can slow down your home sale. To keep the process moving smoothly:

The faster the appraiser completes their assessment, the sooner you can move forward with closing.

Features or upgrades that could raise the value of your home are worth compiling together to show the appraiser.

For example, the appraiser might overlook quartz countertops and mistake them for quartzite (a cheaper, man-made material). This goes for upgraded water heaters, furnaces, pools, and roofs as well.

Include the date of installation, cost with receipts, and permits if available/applicable. However, just because the material or upgrade may be worth a certain amount, it doesn’t mean it will transfer dollar for dollar to your home’s selling price. A prior appraisal can also be useful information to the appraiser.

Appraisals focus on the value of your house, not repairs. However, repairing small things around the house may prevent the appraiser from having to return. Putting on a fresh coat of paint to cover chips or cracked paint can do wonders.

Also, spruce up your home’s curb appeal and invest some time into landscaping. All light switches, wall outlets, fans, and vents should be in working order.

Appraisers need to inspect all areas of your home, including crawl spaces, the basement, and the attic. Blocked access can slow down the process or require a follow-up visit. To avoid delays:

Making your home fully accessible allows the appraiser to complete their evaluation efficiently and without unnecessary obstacles.

While it's important to be available in case the appraiser has questions, hovering or following them around can be distracting. Stay nearby so you can answer any questions, but avoid shadowing their every move.

Appraisers often walk through the home multiple times to complete their inspection, so giving them the space to work efficiently is crucial. If you have a list of upgrades, receipts, or other relevant paperwork, provide it at the beginning of the appointment to prevent unnecessary interruptions.

Creating a smooth, stress-free environment allows the appraiser to complete their evaluation quickly and accurately.

The home appraisal process can be unpredictable, costly, and time-consuming. Repairs, upgrades, and last-minute fixes can add unexpected expenses and delay your sale. If you’d rather skip the stress and sell your home quickly, selling as-is may be the better option.

With 800CashToday, you don’t have to worry about appraisals, inspections, or repairs. We buy homes in any condition, offering a fast and hassle-free way to close the deal on your terms. Get a no-obligation cash offer today—explore our website or call 1-800-CASH-TODAY to take the next step toward a simple, stress-free home sale.

Source: