Recent Posts

- Is Home Staging Worth It? March 25 2025

- What Is the Difference Between Estate Tax and Inheritance Tax? March 24 2025

- How to Sell Your House Fast in Austin, TX March 11 2025

When selling a house, the final amount you take home is often much lower than the sale price.

Various costs—such as agent commissions, closing fees, and mortgage payoffs—can significantly impact your net proceeds. Understanding these expenses can help you estimate how much you’ll actually receive after the sale is complete.

This guide breaks down the key factors that determine your net proceeds and how different selling methods can affect your final payout.

The sale price of a home is the total amount a buyer agrees to pay, but the net proceeds are the actual amount the seller takes home after all selling costs are deducted. Many homeowners assume they will receive the full sale price, but various expenses—such as commissions, closing costs, and mortgage payoffs—can significantly reduce the final payout.

Key Differences:

Because these costs can add up, it is important for sellers to calculate their estimated net proceeds from a sale before listing their home to avoid unexpected financial surprises at closing.

Several costs can reduce the amount you take home when selling your house. Understanding the expenses that will be subtracted from the proceeds from the sale of your home can help you plan ahead and avoid surprises at closing.

If you sell your house through a real estate agent, you’ll typically pay 5-6% of the sale price in commissions. This fee is usually split between the buyer’s and seller’s agents.

Additional expenses may include:

Sellers generally pay 2-5% or more of the sale price in closing costs, which may include:

If you still owe money on your mortgage, the remaining balance must be paid off from the sale proceeds. Additionally, if you’re selling a house with any outstanding property liens (e.g., unpaid taxes or contractor debts) they must be cleared before closing.

Many buyers request repairs after the home inspection, which can further reduce your net proceeds. Some sellers also invest in pre-sale renovations to attract higher offers, such as:

In addition to commissions and closing costs, taxes and other expenses can further impact your net proceeds.

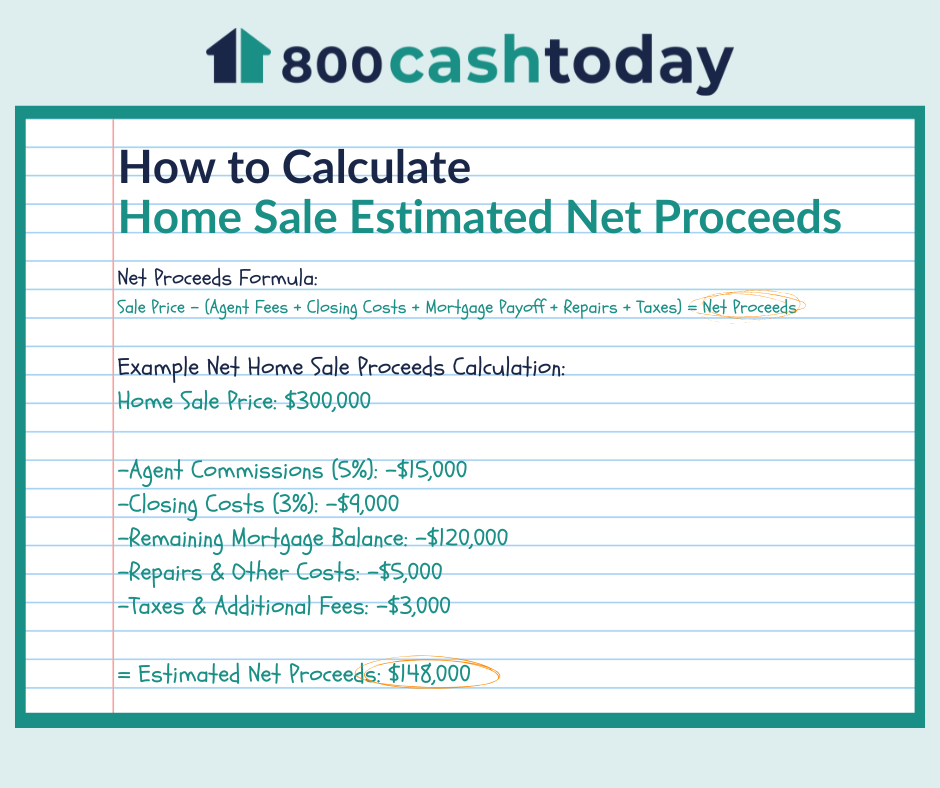

To estimate home sale proceeds, or how much you will take home after selling your house, you need to subtract all selling costs from the sale price. While exact amounts vary based on location and circumstances, you can use a simple formula to get a general idea of your net proceeds.

At closing, the seller typically receives their proceeds via wire transfer or cashier’s check after all selling costs, mortgage balances, and fees have been deducted. The title company or escrow agent handles the distribution of funds.

If you can’t afford closing costs, you may negotiate for the buyer to cover them or explore assistance programs that help with selling expenses.

Market conditions, location, home condition, and buyer demand all play a role in determining your final sale price.

Selling a house comes with many costs that can significantly reduce your final payout. From agent commissions and closing fees to repairs and taxes, these expenses add up quickly. However, selling to 800CashToday allows you to keep more money in your pocket by eliminating many of these costs.

With 800CashToday, you can:

If you’re looking for a simple, stress-free way to sell your home for cash and maximize your net proceeds, 800CashToday can help. Get a free, no-obligation cash offer today and see how much you can take home!